The Basic rules of Stock Market Trading and Investing which are still useful even after more than 120 years of publishing formulated by Charles H. Dow, the Founder Editor of the Wall Street Journal and Co-Founder of Dow Jones and Company. We have presented theses rules with charts for better understanding

The Basic

rules of Stock Market Trading and Investing which are still useful even after more

than 120 years of publishing. Modern Day Analysts are now combining both the

Dow Theory and Candlesticks for better accuracy.

Whether you

are trading Short-Term, Positional, Long-Term, or even Futures and options,

this theory is useful.

Here are

the 6 Rules:

1. MARKET DISCOUNTS EVERYTHING

Charles Dow

says the Stock Price and Index Price reflect all news and information

available. The Dow Theory operates on Efficient Market Hypothesis where only

information which is still unknown is only excluded such as natural calamities.

But these events are priced in the form of risk. If they are not priced in,

market starts to respond to these news and information very early.

Here is the Sensex Chart (hourly) from 20-Feb-2020 to 23-Mar-2020, where Index was discounting Corona Virus fear and Index fell from 41300 to 26300 even before actual first wave started in India.

2.

THE THREE

TREND MARKET

Dow Theory

uses Trend Analysis to understand overall Market Movement. The Three trends

are:

i. Primary

Trend

The Primary

trend is the Most Important to be determined as this is the Major trend of the

Market or Stock. Charles Dow believed Primary Trend last anywhere from 1 year

to 3 year, but it may vary sometime. It can be an Uptrend, a Downtrend or a

sideways movement.

ii. Secondary

Trend

While the

Market tends to move in one Direction of Primary Trend, it doesn’t move in One

Straight Line. Within the Primary Trend

of Up move or Down move, we may get a Secondary Trend which is always in

opposite direction. So if the Primary Trend is of Up move, Secondary Trend

would be of Down move and if the Primary Trend is of Down move, Secondary Trend

would be of Up move. Secondary Trend lasts for 1 month to 3 months. This is

also called intermediate trend where Index moves in opposite director for

around 1/3rd to 2/3rd of the last primary trend move.

iii. Minor Trend

This

is fluctuation within the Primary Trend and Secondary Trend which last from

intraday price movement to less than 3 weeks. Dow Theorists rarely focus on

this trend as it may distract the traders and lead to irrational trading.

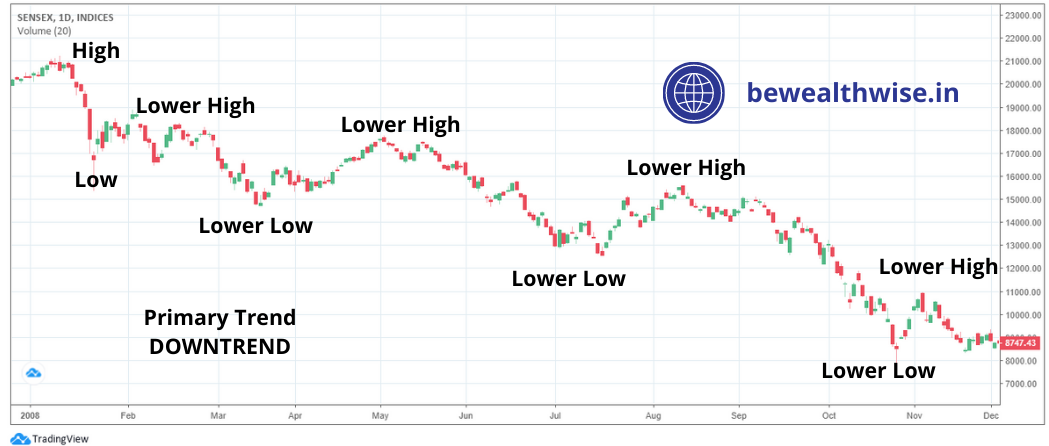

Here is

Three Charts of Uptrend (Sensex from 2003 to early 2008), Downtrend (Sensex

from early 2008 to early 2009) and sideways (Reliance Industries Limited from

Mid 2014 to early 2017), where all 3 trends, Primary, Secondary and minor are also

clearly visible.

3. THREE

PHASES OF PRIMARY TREND

Primary

Uptrend in a Bull Market has 3 Phases

i. Accumulation

This happens

right after a steep fall in the Index and the general mood of the Common people

is of pessimism and stocks are trading at an attractive valuation. This is the

time when acquainted investors starts buying the stocks.

ii. Participation

Once the

“Smart Money” buys huge quantity of stocks in first phase, short term trader

can sense a support and starts buying. With the increase participation from

many traders price tend to increase rapidly.

iii. Euphoria

When

everyone starts talking about stocks and even junk stocks start hitting 52-Week

high, euphoria builds. This is the time when the “Smart Money” which bought at

the accumulation phase starts booking their profit in distribution pattern.

Here is the Chart from early 2002 to 2008 of complete Bull market:

_1608968453op7HS.png)

Primary

Uptrend in a Bear Market has 3 Phases

i. Distribution

The Last

phase of Bull market is the first phase of Bear Market; where markets are may

be still going up, but the smart money starts selling their earlier trades of

bull market.

ii. Participation

Once the

“Smart Money” sells huge quantity of stocks in first phase, liquidity in the

market rapidly reduces. Sentiment starts going down as the time goes by and

market discount even further weakness.

iii. Panic

The last

phase where buying dries, margin calls start triggering and nobody wants to

touch the stock again. This is when people panic; index sees deep cuts and

sometimes selling freezes.

Here is the

Chart from early 2008 to Mid 2009 of complete Bear market:

_1608968477nT4Kt.png)

4. THE INDICES MUST CONFIRM EACH OTHER:

According

to Charles Dow, every index should move in similar direction to establish a

Primary Trend. So if someone is Bullish on ‘Sensex’, trend cannot be

established based on that one Index only, rather all other indices should also

confirm the trend. Similarly, if someone is bullish on Real Estate Stocks, they

must all be bullish on Cement, Steel and other related stocks.

5. VOLUMES MUST CONFIRM THE TREND

There are 4

possibilities for price and volume combination:

Price goes

up with volume also going up

Price goes up

without volume going up

Price goes

down with volume going up

Price goes

down without volume going up

Charles

believed that the volumes must go up for deciding the trend; hence, if Price

goes up with volume also going up; it is signalling a Bull Market. In the same

way, Price goes down with volume goes up; it is signalling a Bear Market. If

many participants are active, the volume is supposed to be high and price is

also supposed to move in that direction.

When Price

goes up without volume going up, it is just because of some over aggressive

buyers and when Price goes down without volume going up, it is just because of

some over aggressive sellers.

6. TREND REMAINS UNTIL PROVED OTHERWISE

Within the same trend, say primary trend uptrend, we may some reversals, which are Secondary trend-where price contrast 1/3rd to 2/3rd of previous move. However, Charles said, price will soon resume to its primary trend until it is proved that trend has changed. Determining if the trend has changed or not is not easy and many analysts disagree with each other while deciding so.

And that’s why and that’s how market functions !

Leave a comment